A Bird's Eye View

Why use a blockchain?

Key Takeaways

- •Traditional banking systems remain foundational but are plagued by systemic risk, regulatory failures, and entrenched conflicts of interest.

- •DeFi enables permissionless access to financial tools—offering censorship resistance, borderless stablecoin usage, and transparent yield generation.

- •The future of finance will likely emerge from a pragmatic convergence between legacy institutions and decentralized infrastructure.

The global financial system is built on a dense web of intermediaries, handling trillions of dollars in daily transactions. While this architecture has historically supported global trade and capital movement, it also creates persistent bottlenecks, inefficiencies, and systemic risks.

Technology has evolved—but legacy institutions remain entrenched, not just operationally, but politically and socially. Some are deemed too big to fail. Others are quietly allowed to collapse. And though many are reputable, their track records are littered with regulatory violations and unresolved conflicts of interest.

| Institution | Regulatory Fines | Violations |

|---|---|---|

| Bank of America | $82.7B | 214 |

| JPMorgan Chase | $35.7B | 158 |

| Citigroup | $25.4B | 122 |

| Wells Fargo | $21.3B | 181 |

| Deutsche Bank | $18.1B | 59 |

| UBS | $16.7B | 83 |

| Goldman Sachs | $16.3B | 44 |

These numbers reflect a deeper, systemic problem—not just institutional oversight, but a design flaw. The lines between regulator and regulated are often blurry. Former SEC Chairman Gary Gensler spent nearly two decades at Goldman Sachs. Fed Chair Jerome Powell comes from a lucrative investment banking background. The so-called "revolving door" between Wall Street and Washington is not new—it’s the norm.

Central Banking: Mandates and Mechanics

The Federal Reserve—the third central bank in U.S. history—was formed in 1913 after a series of devastating bank runs. Designed by elite financiers like J.P. Morgan, the Fed is a quasi-governmental institution: accountable to Congress in theory, but operationally independent in practice.

Its "dual mandate" was formalized in 1977:

- Maximize employment

- Maintain price stability, interpreted as ~2% inflation

While monetary policy has evolved over time, its tools have remained consistent: interest rate adjustments, balance sheet expansion, and open market operations. Since 2012, the Fed has explicitly targeted 2% annual inflation—a goal with widespread implications for asset values and the purchasing power of the U.S. dollar.

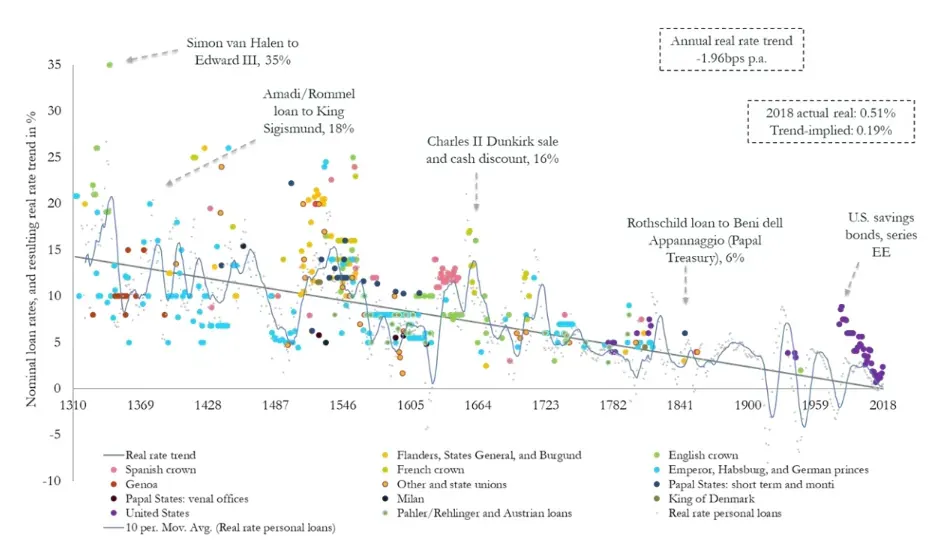

Over the long arc of history, interest rates have followed a steady downward trend.

Value and Perception

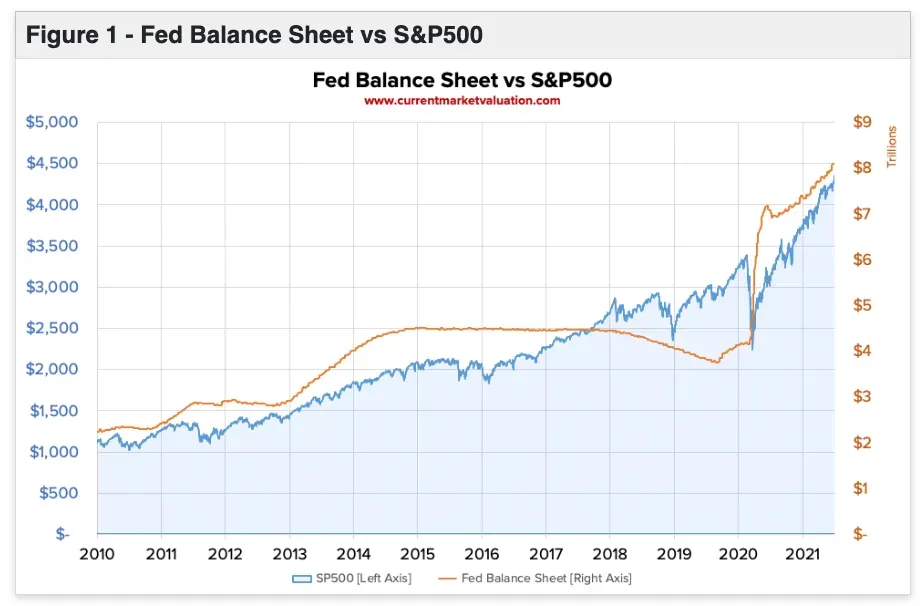

The Fed’s balance sheet and the S&P 500 have become increasingly correlated, raising questions about the long-term impact of monetary expansion.

Some argue that U.S. dominance allows it to print freely without consequence—that the dollar's reserve status and global trust in American institutions buffer against inflationary decay. But not every country enjoys that privilege.

In many parts of the world, DeFi isn’t an alternative—it’s a necessity.

#DeFi: An Evolving Parallel System

Where traditional finance is constrained by borders, hours, and intermediaries, DeFi offers programmable, permissionless alternatives. It doesn’t require access, approvals, or a bank branch—it requires an internet connection and a wallet.

Stablecoins and Inflation Hedges

Take Turkey. Between 2021 and 2022, the Turkish Lira lost 78% of its value to inflation. For citizens, local banks offered no effective recourse. But DeFi did. With stablecoins and non-custodial wallets, users could secure value, transact globally, and bypass capital controls—all with open-source tools accessible to anyone with a phone.

These wallets require no bank account, no paperwork—just a private key. That simplicity is powerful. Moving capital across borders through traditional systems is slow, expensive, and limited. In DeFi, it’s instant.

Censorship Resistance

In 2022, China froze $1.5 billion in customer deposits across rural banks in Henan. When protestors gathered, officials turned their COVID health passes from green to red, restricting travel and blocking dissent.

By July, nearly one million people were locked out of their funds.

Then came tanks.

This isn’t just a case study in censorship—it’s a warning. Financial autonomy isn’t guaranteed in centralized systems. DeFi offers a different model: one resistant to manipulation, built on open infrastructure, and governed by code instead of policy.

Yield and Innovation

DeFi protocols have reimagined financial primitives: lending, borrowing, trading, insurance. Some innovations are real. Others—like Celsius—have collapsed under mismanagement and opaque risk exposure.

I met Celsius founder Alex Mashinsky before its downfall. He looked hollow. The math never made sense, and it eventually caught up with him.

But not all yield is smoke and mirrors.

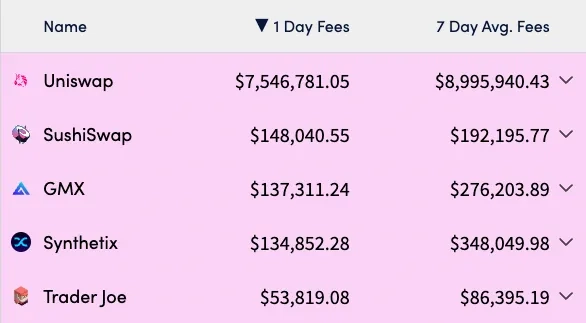

Automated Market Makers (AMMs) and liquidity pools power decentralized exchanges (DEXs) like Uniswap. These protocols distribute trading fees to liquidity providers, creating decentralized, transparent market-making structures that anyone can participate in.

This is a departure from traditional finance, where market access is often gated and opaque. In DeFi, code is law, and participation is open.

Ryan Selkis, founder of Messari, recently posted 35 use cases for DeFi—from remittances and undercollateralized lending to DAO treasury management. It’s worth a scroll.

#A Balanced Future

The future of finance probably won’t be fully decentralized—or fully centralized. It will be hybrid.

DeFi isn't a wholesale replacement for traditional finance. But it addresses gaps that legacy systems ignore: accessibility, censorship resistance, and transparency. In economies plagued by inflation or financial repression, DeFi is already solving real-world problems.

The path forward lies in intelligent integration: stablecoins, CBDCs, on-chain banking infrastructure. DeFi can complement, not just compete with, traditional systems.

#Expert Perspectives

“DeFi protocols represent a paradigm shift in financial infrastructure, offering programmable and transparent alternatives to traditional financial services.”

— Dr. Fabian Schär, Professor of DLT, University of Basel

“While DeFi platforms may offer promising technological innovations, they still need to operate within a framework that protects investors and maintains market integrity.”

— Gary Gensler, Former SEC Chairman

“The goal of DeFi isn't to oppose traditional finance, but to create an open, accessible financial system that complements existing infrastructure.”

— Vitalik Buterin, Ethereum Co-founder

#Why It Matters

DeFi’s architecture—permissionless, global, transparent—unlocks new financial freedoms. It removes barriers of geography, status, and institutional gatekeeping. Smart contracts automate complexity, slash costs, and eliminate friction in ways legacy infrastructure simply can’t.

Yes, there are risks. But there’s also progress.

In a world of economic volatility and institutional mistrust, decentralized systems offer something rare: optionality. And in finance, optionality is power.