In 2001, a church in Halberstadt, Germany began performing John Cage's organ piece ASLSP (As Slow as Possible). The performance will last 639 years—the age of the church when it started.

The most recent note change was September 5, 2020. The next one: February 5, 2022. The final note: September 5, 2640.

On that day in 2640, there will also be a new Noun auctioned.

Time as Medium

Most NFT projects launch with a mint: 10,000 images drop at once, early buyers get in cheap, and value concentrates among those who showed up first. The distribution is instant, and the power dynamics are set from day one.

Nouns inverts this.

One Noun is created and auctioned every 24 hours. No presale, no whitelist, no rush. The auction settles, 100% of proceeds go to the treasury, and a new Noun appears for the next day's auction.

On day 1, the founders (Nounders) control a significant percentage of supply. On day 100, their percentage has shrunk. On day 1,000, they're a small minority. On day 10,000, they're statistically irrelevant.

The project gets more decentralized with every sunrise. Time does the work.

The Mechanism

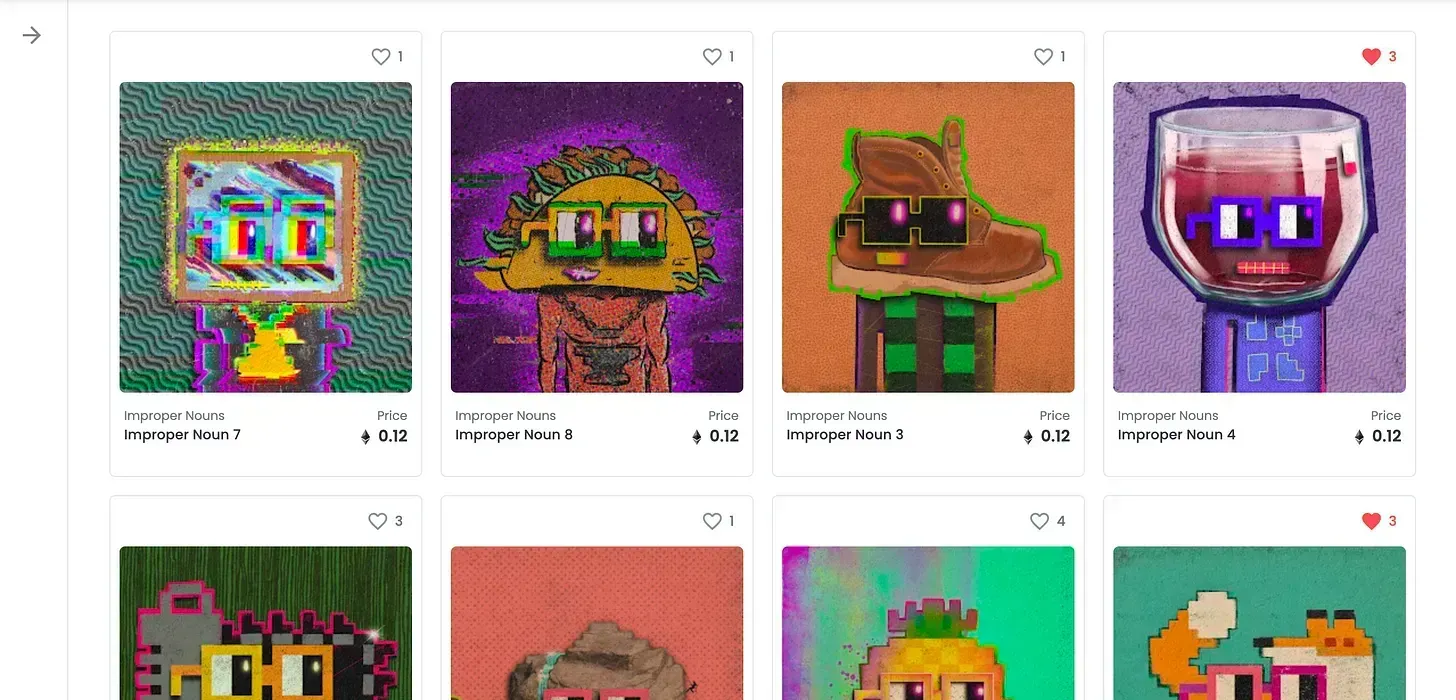

Each Noun is a generative 32×32 pixel character—random combinations of heads, bodies, accessories, and backgrounds. A smart contract controls everything: generation, auction, settlement, treasury deposit.

When an auction ends, the Noun transfers to the winning bidder, ETH goes to the treasury, a new Noun is minted, and the next auction begins. No human in the loop.

Founder Economics

The Nounders receive every 10th Noun for the first five years—their compensation for building the protocol. This is more transparent than most founder allocations: you can calculate exactly how much they'll receive and when their influence will peak.

After five years, the founder rewards stop. The dilution continues. Eventually, the Nounders become just another set of voters in a sea of participants.

Governance

Three weeks after launch, 24 Nouns controlled over $11 million in ETH. Submitting a proposal required 5% of supply—a threshold that gets harder to meet as supply grows, meaning governance becomes more distributed over time, not less.

The DAO had already disbursed 30 ETH to six charities, all verifiable on-chain. It's too bad governments don't have public ledgers for spending our money.

The 2023 Fork

In September 2023, NounsDAO implemented "Nouns Fork"—a mechanism allowing dissatisfied token holders to exit with their proportional share of the treasury.1 Over 50% of Noun holders chose to fork, draining approximately 27,000 ETH (~$45M at the time) from the treasury.

The fork revealed tensions in DAO governance: when exit is easy, coordination becomes harder. The remaining treasury dropped from ~$50M to approximately $20M.2 Daily auctions continued, but at significantly lower prices—often below 10 ETH compared to peaks above 100 ETH in 2021-2022.

The experiment continues, but with different parameters than originally envisioned.

Time as Medium, Revisited

Most projects optimize for speed. Ship fast, scale fast, exit fast. Cage wrote a piece designed to outlast everyone who would ever hear it. The Halberstadt performance will continue through wars, economic collapses, technological revolutions—whatever the next six centuries bring.

Nouns made the same bet. The contract doesn't care about market conditions, competitor projects, or founder interest. One Noun, every day, until Ethereum stops running.

ASLSP has an ending. Nouns doesn't.

Whether that's profound or pointless depends on what you think time is for. The 2023 fork tested this premise: time continues to pass, Nouns continue to be minted, but the treasury and community have fundamentally changed. Perhaps that's also part of what slow mechanisms reveal—not just gradual decentralization, but the full complexity of human coordination over time.

Footnotes

-

The fork mechanism was implemented via governance proposal, allowing any Noun holder to exit the DAO and receive their pro-rata share of treasury ETH. This was designed as a safety valve against majority tyranny, but resulted in a mass exodus. ↩

-

Treasury data from NounsDAO public dashboard and Etherscan. The treasury peaked at approximately $100M in late 2021 before the bear market and fork. Current treasury fluctuates with ETH price but remains substantially below peak levels. ↩

NounsDAO

crypto

Using time itself as a decentralization mechanism

3 min readAugust 31, 2021

crypto

In 2001, a church in Halberstadt, Germany began performing John Cage's organ piece ASLSP (As Slow as Possible). The performance will last 639 years—the age of the church when it started.

The most recent note change was September 5, 2020. The next one: February 5, 2022. The final note: September 5, 2640.

On that day in 2640, there will also be a new Noun auctioned.

Time as Medium

Most NFT projects launch with a mint: 10,000 images drop at once, early buyers get in cheap, and value concentrates among those who showed up first. The distribution is instant, and the power dynamics are set from day one.

Nouns inverts this.

One Noun is created and auctioned every 24 hours. No presale, no whitelist, no rush. The auction settles, 100% of proceeds go to the treasury, and a new Noun appears for the next day's auction.

On day 1, the founders (Nounders) control a significant percentage of supply. On day 100, their percentage has shrunk. On day 1,000, they're a small minority. On day 10,000, they're statistically irrelevant.

The project gets more decentralized with every sunrise. Time does the work.

The Mechanism

Each Noun is a generative 32×32 pixel character—random combinations of heads, bodies, accessories, and backgrounds. A smart contract controls everything: generation, auction, settlement, treasury deposit.

When an auction ends, the Noun transfers to the winning bidder, ETH goes to the treasury, a new Noun is minted, and the next auction begins. No human in the loop.

Founder Economics

The Nounders receive every 10th Noun for the first five years—their compensation for building the protocol. This is more transparent than most founder allocations: you can calculate exactly how much they'll receive and when their influence will peak.

After five years, the founder rewards stop. The dilution continues. Eventually, the Nounders become just another set of voters in a sea of participants.

Governance

Three weeks after launch, 24 Nouns controlled over $11 million in ETH. Submitting a proposal required 5% of supply—a threshold that gets harder to meet as supply grows, meaning governance becomes more distributed over time, not less.

The DAO had already disbursed 30 ETH to six charities, all verifiable on-chain. It's too bad governments don't have public ledgers for spending our money.

The 2023 Fork

In September 2023, NounsDAO implemented "Nouns Fork"—a mechanism allowing dissatisfied token holders to exit with their proportional share of the treasury.1 Over 50% of Noun holders chose to fork, draining approximately 27,000 ETH (~$45M at the time) from the treasury.

The fork revealed tensions in DAO governance: when exit is easy, coordination becomes harder. The remaining treasury dropped from ~$50M to approximately $20M.2 Daily auctions continued, but at significantly lower prices—often below 10 ETH compared to peaks above 100 ETH in 2021-2022.

The experiment continues, but with different parameters than originally envisioned.

Time as Medium, Revisited

Most projects optimize for speed. Ship fast, scale fast, exit fast. Cage wrote a piece designed to outlast everyone who would ever hear it. The Halberstadt performance will continue through wars, economic collapses, technological revolutions—whatever the next six centuries bring.

Nouns made the same bet. The contract doesn't care about market conditions, competitor projects, or founder interest. One Noun, every day, until Ethereum stops running.

ASLSP has an ending. Nouns doesn't.

Whether that's profound or pointless depends on what you think time is for. The 2023 fork tested this premise: time continues to pass, Nouns continue to be minted, but the treasury and community have fundamentally changed. Perhaps that's also part of what slow mechanisms reveal—not just gradual decentralization, but the full complexity of human coordination over time.

Footnotes

-

The fork mechanism was implemented via governance proposal, allowing any Noun holder to exit the DAO and receive their pro-rata share of treasury ETH. This was designed as a safety valve against majority tyranny, but resulted in a mass exodus. ↩

-

Treasury data from NounsDAO public dashboard and Etherscan. The treasury peaked at approximately $100M in late 2021 before the bear market and fork. Current treasury fluctuates with ETH price but remains substantially below peak levels. ↩